You the power of forgiveness in the bible could pay money for items, shop well worth, or even secure give — without worrying that the harmony you will crash right away. Access USDC, the world’s largest controlled electronic money, from international business. Micropayments to possess AI services, internet scraping, or affect measuring – shell out per play with immediately.

The power of forgiveness in the bible: USDT (Tether) – $144 Billion

Checkout making use of your well-known fee method such as borrowing/debit cards, lender import, PayPal, and you will Venmo. And if you’ve decided it is the right time to cash out for the bank account, you can promote stablecoins to have fiat money. Very first Electronic USD (FDUSD) try a fairly the fresh entrant regarding the stablecoin business, create having an emphasis on the openness and you will compliance. It is supported by USD stored inside the reserves and you will audited monthly by the another accountant. FDUSD goals organizations and people looking a reliable, blockchain-dependent alternative for payments, remittances, and you can savings. The brand new Wizard Operate at the same time treats for each and every permitted stablecoin issuer since the a great “lender” under the You.S.

- The guy came up with the notion of resource-labelled cryptocurrencies inside 2012 and you will said they in the white paper to possess his MasterCoin method.

- They enable it to be involvement from the around the world electronic cost savings for those previously omitted, generating financial inclusion.

- Should your issuer of one’s stablecoin does not have the newest fiat needed to make exchanges, the new stablecoin can remove well worth and become worthless.

- However, the new volatility of your underlying cryptocurrencies introduces higher threats versus fiat-backed choices.

Unlock the ongoing future of cash on Gemini

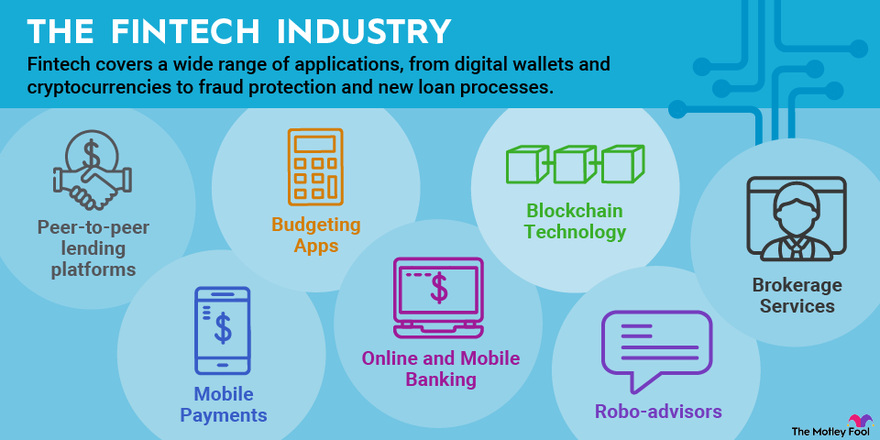

Meanwhile, very resellers don’t want to become losing money if the cost of a great cryptocurrency plunges after they get money inside they. The concept of stablecoins emerged while the a solution to the new volatility state within the crypto areas. While the digital use develops, stablecoins is all the more used for remittances, payroll, financing, discounts, and you can global trading. Inside our experience, financial institutions are especially concerned about the ongoing future of lender places. The newest growing level of transactions which have stablecoins was named a danger so you can traditional commission communities, such credit card companies.

Furthermore, people in politics on the You.S. have raised requires firmer controls of stablecoins. For instance, within the November 2021, Senator Cynthia Lummis (R-Wyoming) required normal audits away from stablecoin issuers, while others right back financial-such regulations to your market. Inside 2024, Senators Lummis and you may Kirsten Gillibrand produced a bill to make an excellent regulating construction to own stablecoins. Its advised construction manage ban anyone of issuing a good stablecoin unless these people were a subscribed low-depository believe otherwise a great depository business with authorization to help you thing them. Stablecoins consistently come under scrutiny because of the authorities, given the rapid growth of the brand new $162 billion industry and its potential to affect the larger economic system. Inside the October 2021, the newest International Business away from Bonds Profits (IOSCO) told you stablecoins might be regulated since the economic field structure close to commission options and you may clearinghouses.

Stablecoins are another category of cryptocurrencies made to remove the brand new volatility built-in inside antique digital property. These types of tokens seek to care for a reliable worth, typically by pegging so you can fiat currencies or products, which makes them a stylish device to have casual transactions and cost shops. Fiat-recognized stablecoins would be the most popular and you may leading stablecoins. They typically trust supplies of very liquid assets including dollars and you may small-identity government ties to make sure the well worth remains steady. But not, not all the fiat-backed stablecoins supply the exact same number of openness, regulating compliance, otherwise put aside support, that may cause differing degrees of believe and adoption. Stablecoins you will need to peg the market price for some exterior site, usually a great fiat money.

As to the reasons stablecoins have cultivated in the popularity

Stablecoins are cryptocurrencies built to manage a reliable really worth prior to a specific resource or basket away from assets. As opposed to conventional cryptocurrencies such bitcoin or ethereum, that may sense high rate motion, stablecoins seek to provide a regular store useful and you may typical out of change. Which stability is normally attained because of various components, as well as investment-support, algorithmic handle or a variety of one another.

Thereafter, the new Chairman’s Functioning Category to the Financial Areas demanded in the 2021 you to definitely stablecoin issuers be managed as well as their reserves audited. That have a whole business capitalization of over $190 billion, stablecoins provides swiftly become a go-in order to equipment on the digital money globe. This type of electronic assets are made to keep regular, providing you the stability out of conventional currency to the price and you may capacity for cryptocurrency.

For taking benefit of the fresh stablecoin chance, creditors will be basic choose which character or spots to visualize on the digital ecosystem. Along with her, such advancements has turned the underlying tech to have tokenized payments from a fresh environment in order to an even more strong monetary system ready supporting traditional costs-founded fool around with cases. Before number of years, the newest structure to have tokenized dollars, along with blockchain, purses, as well as on-chain analytics, has the grow, deciding to make the ecosystem more secure, scalable, and you will representative-amicable.12“What’s Web3? 2025 is generally an essential 12 months on the growth of tokenized cash, facing less headwinds away from skeptics out of cryptocurrencies and you will several tailwinds linked to more positive controls, improving defense technical, and you may testing. The fresh every day volume of transactions which have stablecoins is around $100 billion2. “Because the stablecoins are incredibly simply a form of put membership, we feel this type of developments probably portray a lot more progressive chance rather than exposure to your percentage communities,” according to him.

They’re also usually overcollateralized to help you take into account cryptocurrency rates volatility. The brand new Secretary will likely then report the conclusions on the Home Economic Features Committee as well as the Senate Financial, Houses, and you will Urban Issues Panel. Such as stablecoins, blockchains are another know-how and therefore are nonetheless increasing right up. While they move beyond adolescence and you may to your full maturity — backed by a more complete regulatory construction — we feel they’ll render of numerous user benefits and help push overall performance progress inside the electronic payments or any other economic characteristics. Another challenge the brand new crypto globe faces is the fact it’s apparently slow and you will expensive to transfer cash to your crypto, and you can the other way around. This may make it awkward and you will inefficient to possess crypto traders looking so you can trade-in and you can of crypto.

This makes stablecoins around the world available and you will appealing around the monetary groups. In the places hit by the hyperinflation or currency collapse, anyone turn to stablecoins as the a shop useful. Which have minimal access to the worldwide economic climate, stablecoins give an alternative. Inside Argentina, for example, someone play with USDT to flee peso devaluation. Stablecoins as well as increase monetary inclusion by providing unbanked people access to electronic currency.